Despite more than a decade of efforts to address the problem, cancer patients across Europe and the US still cannot rely on essential drugs being available when they need them. Rachel Brazil looks at the size of the problem, its impact on patients and professionals, and the efforts to put in place policies and alternative business models that could offer a solution.

For the last decade, headline stories about problems accessing cancer drugs have focused almost exclusively on novel ‘targeted’ treatments. Less publicised is the story of growing problems accessing traditional cytotoxics and other oncology medicines that are no longer on patent, but remain the real workhorses of oncology care across most cancer types.

Health services have traditionally relied on the generics market to provide affordable copies of brand-name drugs once the patent that gives market exclusivity has expired. But a persistent problem of re-occurring shortages across a wide range of generics is damaging patient outcomes, adding to the workloads of hospital pharmacists and others in the care team, and raising questions about how to balance the need for competition against the requirement of a guaranteed supply line.

Whilst the problem is not unique to oncology, shortages of generic drugs have hit cancer treatment hard. This is because generics form such an important part of treatment protocols, and because if a particular drug is unavailable, it is often not possible to substitute something similar.

Adrian van den Hoven is Director General of Medicines for Europe, the representative body of the European generics industry. “If you look at the number and the volume of drugs provided to patients for cancer they would mostly be generic medicines,” he points out.

A worldwide problem

That countries in central and eastern Europe face the greatest problems may come as no surprise. Less expected, however, are the growing reports of shortages across the whole of Europe as well as the US. After a decade of failure to fix this, it is clear the problem is complex and multi-faceted and will need some radical solutions.

In 2014 the European Association of Hospital Pharmacists (EAHP) published the first pan-European survey on drug shortages in the hospital sector. A second survey published in 2018 indicated that, despite efforts to counter shortages, the problems may be getting worse. Of 1,666 respondents across 38 countries, almost 92% reported experiencing shortages compared with just over 86% in 2014. Almost two in five respondents said the problem occurred on a weekly basis and typically lasted a few months.

The past five years have seen global shortages of at least ten essential oncology drugs: bleomycin, carboplatin, carmustine, cisplatin, fluorouracil, gemcitabine, irinotecan, methotrexate, mitomycin and etoposide. Part of the problem is that it’s a “moving target”, argues Alexandru Eniu, a medical oncologist at the Ion Chiricuta Cancer Institute in Cluj, Romania. Eniu contributed to a 2017 report on Cancer Medicines Shortages in Europe published by the Economist Intelligence Unit together with the European Society for Medical Oncology. “Shortages occur and then they get solved and then they re-occur,” he says.

In Romania, says Eniu, shortages occur almost daily for certain medicines, “and this is affecting the activity of a large number of oncologists and the prognosis of many many patients” – patients like those Eniu was treating two years ago: “I had to treat breast cancer without tamoxifen for six months… There is no replacement for certain breast cancer patients.” Medicines predominantly used in childhood cancers are also in chronically short supply, he adds.

In neighbouring Hungary, shortages of generic drugs for cancer started to be reported in 2012. “Previously there were just shortages of vaccines or orphan drugs, but oncology was new,” says Róbert Vida, a pharmacy researcher from the University of Pécs. Whilst many shortages are global, says Vida “not all of the drugs are used by all countries, so there is a different pattern of drug shortages from country to country.”

The United States also experiences shortages. The FDA (US drug regulator) recorded a total of 306 shortages in 2018. As of December 2018, 16 active chemotherapy drugs were in short supply. “Shortages in general were getting better,” says Erin Fox, director of Drug Information at the University of Utah Health Care, “but in the middle of 2017 they started to get much worse, with lots of shortages of very basic products.” The biggest impact on oncology patients currently is in supportive care, says Fox, including the saline bags needed to make up antiemetic infusions and pain relief drugs such as morphine and hydromorphone. The problem was caused by manufacturing shutdowns at several large Pfizer facilities.

The past five years have seen global shortages of at least ten essential oncology drugs

One ongoing shortage in both Europe and the US is of the BCG (Bacillus Calmette-Guerin) vaccine, an intravesical immunotherapy used to treat early-stage bladder cancer. “It is very troublesome right now, here in the US, with supplies not being as readily available as we would like,” says Fox. This particular shortage started in 2012, when its supply was disrupted in Europe due to a temporary suspension of production in Sanofi Pasteur’s Toronto manufacturing facility. In 2016 the company announced production would stop completely by 2018, leaving only an alternative inferior strain.

Shortages can be local, such as the 2012 shortage in Germany of 5-fluorouracil, a cytotoxic used to treat colorectal and a variety of other cancers. This happened as a consequence of Teva Pharmaceuticals pulling out, leaving a sole remaining German manufacturer.

The knock-on effect, however, was felt across eastern and central Europe, says Eniu. “In these countries prices are somewhat lower than in other countries, such as Germany or the Netherlands. So obviously if they have only 100 vials of the drug or tablets, the producers will sell them to the country that pays more.”

Vida sees similar ‘parallel exporting’ in Hungary, “The economic power of a country has an effect on what is available, so countries with more patients and more money get what is left, and countries like Hungary won’t get the drugs.”

Poland, Romania, Bulgaria, and Greece also suffer in this way, according to Aida Batista, Vice-President of the European Association of Hospital Pharmacists and director of the pharmacy at Centro Hospitalar in Vila Nova de Gaia, in Portugal. She adds that, although against EU law, “In Poland and also in Portugal the governments have taken measures to avoid parallel exports of products that are experiencing shortages in other countries.”

Impact on patients

When cancer drug shortages occur they have real impacts on patients.

In Hungary, Vida says he has experienced shortages of the drugs carmustine and melphalan used as part of a multidrug combination for treating lymphoma. “Usually [shortages] can be solved with a generic substitution or individual importation from other European countries,” but he says on occasion they have had to settle for a second-line treatment: “it was more expensive and had more side effects.”

Similarly, oncologist Umberto Tirelli of the National Cancer Institute in Aviano, Italy, reported carmustine shortages in May 2011, with stocks running out during autologous bone marrow transplantation of nine lymphoma patients. They were forced to modify treatment plans, leading to longer waiting periods for some patients (those already achieving good results) and the use of an experimental alternative drug.

The rate of bladder cancer recurrence increased from 16% before the shortage to 43% in those treated during the shortage

A US study published in 2013 looked at two periods of treatment in 2010 and 2011 at a New York cancer centre, where approximately one in ten patients had their treatments changed due to shortages of paclitaxel (Taxol), which was substituted with docetaxel (Taxotere) – a more expensive alternative. The physicians involved considered the alternatives less effective in almost one in three patients.

The global shortages of the BCG vaccine have meant rationing in many regions. From 2012 to 2016 the French National Agency for Health Products Safety (ANSM) restricted its use to the highest-risk groups and stopped maintenance treatments. Marc Colombel, a French oncologist at Edouard Herriot Hospital, in Lyon, reported on the impact at a recent oncological urology meeting. He looked at outcomes in a patient group that had been ‘sub-treated’ during this period, and found a significant clinical and economic impact.

The rate of bladder cancer recurrence increased from 16% in those treated prior to the shortage to 43% in those treated during the shortage. The risk of surgical removal of the entire bladder increased. And the overall economic impact was a doubling of subsequent treatment costs.

Given such adverse impacts on outcomes, there is also a worry that, when official supply lines run dry, patients and hospitals may try to source unavailable drugs from black market internet vendors.

Vida and colleagues conducted a study of the vast number of online pharmacies which, while not legal, seem to operate with relative impunity. “We saw that even when they are not available in the legal supply chain, these drugs are available [online],” he says. He identified online sources for all cancer drugs that were in short supply in Hungary in 2016, including cisplatin, oxaliplatin, doxorubicin, fluorouracil, and methotrexate. From previous studies he suspects these drugs were authentic generics, but may have been beyond their expiry date and incorrectly stored. Vida is not yet aware of any patients having purchased cancer drugs online, but says in Hungary there are concerns that private clinics may look to these kinds of sources.

Impact on healthcare professionals

Shortages of cancer drugs also impact heavily on workloads. The 2018 EAHP survey found that almost two in five respondent pharmacists spent at least five hours a week dealing with shortages. “It’s always a burden on doctors, pharmacists and nurses,’ says Batista. “Suddenly we receive a phone call saying ‘We don’t have this,’ and you have to make lots of calls to another hospital and vendors. We have an informal network between hospitals to ask: ‘Please lend me this, and I’ll lend you this.’

“We spend a lot of time reaching agreements with the doctor and deciding ‘for this patient I want this and for that patient I want that’, and we have to get it fast if we don’t have it in the hospital.”

The lack of information can make the situation worse, and shortages often create wider ripples, she adds. “When there is a shortage of one medicine and we have to change to another, everybody changes together, so the demand increases on that medicine and it provokes a shortage of the other one. It’s like a snowball round and round, and sometimes it’s quite difficult to find a solution.”

An enduring problem

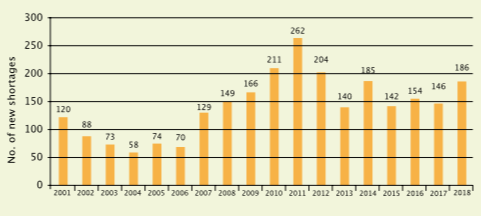

Statistics from the US reporting the number of new drug shortages in the years 2001 to 2018 show the problem is not getting better. Sixteen of the shortages reported in 2018 related to chemotherapy drugs, of which 15 were injectables

Source: Erin Fox, University of Utah Drug Information Service

Cancer services in the US face similar pressures, according to Fox. “We have to do a lot of work trying to figure out how much we have on hand and then figure out strategies so that we can stretch that supply. We’re triaging and rationing.” During the recent shortages of saline bags she says many hospitals would administer antiemetics via syringe: “The patients got the same dose at the end of the day, so that was fine, but the computer work that we had to do… we had to update 700 different order sets [which created] over 100 hours of work.”

The root of the problem

Speaking from the perspective of the European generics industry, van den Hoven argues that the root of the problem lies in policies adopted by “hospitals together with health ministries” in the wake of the 2009 financial crisis. “Over the last few years, for a lot of cancer drugs especially injectable chemotherapy drugs, the policies of most payers has been to try and get the lowest price possible. The end result has been an extreme consolidation of manufacturing. The number of suppliers has really declined dramatically,” he says. He cites the example of Portugal, where he says suppliers of oncology injectables have fallen from eight to two over the past five years, and Italy, where he says 15–20% of hospital tenders attract no bids at all.

One consequence, he argues, is that when problems arise with manufacturing quality or supply chains, these can quickly lead to shortages. “These are unfortunately regular occurrences now because the number of manufacturers is so limited… It’s very difficult for the industry to invest because the prices are so low. There’s no business case.” An example of this situation occurred in 2013 when German pharmaceutical giant Boehringer Ingelheim decided to shut down its Ohio-based contract manufacturing unit Ben Venue Laboratories, which produced the Johnson & Johnson cancer drug Doxil – a pegylated liposome-encapsulated form of doxorubicin that had recently gone off patent. After several years of regulatory and quality control issues and periods of suspended production, the company eventually decided the additional investments needed could not be justified.

Policies and forward planning

As far back as 2001, the European Union passed a directive (2001/83/EC EU Directive) that aimed to minimise the risk of drug shortages. It mandates pharmaceutical companies to provide advance notification of production stoppages, whether permanent or temporary, although they are not obliged to share information on the causes. How this has been implemented varies within EU countries, but only 56% of respondents to the EAHP survey judged their countries’ reporting process to be effective. “What is happening in many countries is that you find out today from the pharmacy that they don’t have any cisplatin,” says Eniu. For patients who are undergoing cycles of chemotherapy this can have a big impact: “Knowing in advance and planning for that is very important and this should be feasible,” he says.

“I think one of the difficulties is there’s no sharing of information across countries,” says Medicine for Europe’s van den Hoven, “and as a result, if you have a genuine manufacturing shortage with an impact across several countries, there isn’t really good coordination.”

One of the most proactive agencies is the French ANSM. “When there is a shortage they establish a process of discussion with all the manufacturers of that product to try to manage the source and increase the supply to prevent a disruption,” says van den Hoven. In 2016 France introduced a new regulatory tool that set out sanctions for industry breaches, but Francois Bocquet, a pharmacist specialising in law and health economics at Paris Descartes University, says the regulation has not really fixed the problem, “as the number of drug shortages has never been so significant. The problem remains major and no therapeutic class is spared.”

The US seems to have had more success in its regulatory response. In 2012 it passed a law that requires manufacturers to report shortages to the FDA, including the reasons and expected duration. This provides the basis of a searchable public database on the FDA website. The FDA is also able to take measures to avoid shortages, although it cannot require a company to increase production of a specific drug.

“This actually made a tremendous difference,” Fox believes, not least because, in dealing with manufacturing and quality issues, the FDA can use regulatory discretion to prevent shortages posing a risk to patients. “For example, if they know there is a batch of vials that have some particles in them, but everything else about the medicine is safe, they can allow the company to sell that product, but with a filter.”

They will also work with alternative companies to help them ramp up production, speedily approving new production lines or raw material sources to help increase supplies, adds Fox. “Back in 2012 there was a significant shortage of methotrexate injections, and the FDA was able to approve another supplier to alleviate the shortage very quickly.”

The FDA can use regulatory discretion to prevent shortages posing a risk to patients

Eniu would like to see more proactive measures in Europe to predict the likelihood of shortages. In Romania the government does step in and make use of special authorisations to get drugs into the country, “but this is always after the fire has started,” he says. “The ideal situation would be a system to prevent it from happening, by taking measures before the shortages actually occur.” The 2017 report on cancer medicines shortages in Europe that he contributed to outlined six policy recommendations to prevent and manage shortages. In April 2019, in advance of elections to the European Parliament, ESMO worked with MEPs to launch a cross-party call for ‘tangible political commitments’ to act on these recommendations as a matter of urgency during the 2019–2024 legislative cycle (see box A call for tangible political commitments).

A market failure?

The report also focused on creating the right financial incentives for industry to improve production infrastructure. Some see this as a key problem, particularly for medicines with relatively small markets. “There are no financial incentives, they are losing money, so I guess the market laws are not functioning very well in this area, especially in the generic low-profit medicines,” says Eniu.

van den Hoven argues that current cost cutting and uncertainty in the generic drugs market makes investment very difficult. “We need to figure out a more long-term predictable scenario so that companies will reinvest again on the manufacturing supply side.” He argues that those in charge of buying medicines need to be part of the dialogue. “They should enable tenders to allow for price competition, but there should be a component of security of supply in there.”

Medicines for Europe has held internal discussions around procurement models that would offer very-long-term contracts, including a requirement to invest in manufacturing capacity. “This is a very radical idea, and it’s not fully accepted by anybody yet,” says van den Hoven, “[but] if we don’t come to this, it’s just going to be uneconomic to manufacture these super-essential drugs, which are the backbone of cancer treatment.”

In the US, one group of healthcare providers is looking at an alternative solution. Intermountain Healthcare, a Utah-based system of 23 hospitals, is leading a collaboration of more than 450 hospitals to form a new not-for-profit generics drug company. This will be the first non-profit generics manufacturer in the US. Civica Rx CEO Martin Van Trieste, an accomplished biopharmaceutical entrepreneur, agrees that the current economic model is broken. “The part that we are doing that really fixes that model is we do not recover a margin, a profit, by selling the drugs.”

A call for tangible political commitments

In an effort to push the issue of shortages of generic medicines higher up the European political agenda, the European Society for Medical Oncology launched a cross-party call for action in April 2019, advocating the following six recommendations:

- Introduce legislation for early notification requirements for medicines shortages.

- Establish European strategic plans for medicines shortages.

- Introduce incentives for production infrastructure improvements including financial incentives to address the economic causes of manufacturing issues. Incentives for suppliers to remain in these markets should also be considered.

- Develop catalogues of shortages based on a common minimum set of data requirements, including a common EU definition of medicines shortages.

- Develop national essential medicines lists based on the World Health Organization’s Model List of Essential Medicines.

- Establish procurement models designed to prevent medicines shortages, including tender-cycle harmonisation.

Civica Rx plans a three-pronged strategy: work with existing manufacturers to make products under Civica’s oversight; develop their own generic drugs under their own FDA licence using contract manufacturing capacity; and set up their own manufacturing facilities. “We are working on all three of those simultaneously,” says Van Trieste, because “we want to be pro-competitive and have redundant manufacturing [capacity].”

To create a more stable market, but retain a competitive environment, Civica will ask current members to sign long-term supply contracts of five, seven or ten years, at a guaranteed price, for half of their annual volume. And, says Van Trieste, “everybody gets the exact same price, so the smallest hospital in the US, which has 10 beds, will pay the same price as the largest health system that runs 500 hospitals.” Fox says she is hopeful that this approach could help tackle shortages in the US.

van den Hoven says Civica’s idea of long-term contracts mirrors his own ideas on stimulating investment. But he is sceptical about whether the 450 collaborating hospitals will be prepared to commit to those long-term contracts. Van Trieste acknowledges their aspirations are ambitious, but adds, “We always say at Civica this is a really hard thing to do, but the reason we are doing it is so important to society that we have to do it.”

A European solution

So could a not-for-profit company work elsewhere? “I’m not sure this whole model works in Europe, mostly because of the intervention of the government and multiple governments,” says Van Trieste.

What is clear is there needs to be pan-European solutions. “In the EAHP opinion, the EU has not yet done enough to solve the medicines shortage problem,” says Batista.

The generics industry is now engaged in discussions at the European level. “We are having a much better dialogue with regulatory agencies and the European Medicines Agency on this issue than we were, say, a year ago,” says van den Hoven. The EU has also funded a research network (CA15105 – European Medicines Shortages Research Network) to address medicines shortages and to reflect on the best coping practices and stimulate new solutions. But it’s likely that shortages will keep occurring until some of the fundamental problems are addressed.

“This is an issue that shouldn’t exist,” says Eniu. “The WHO is promoting a list of essential medicines that should be available in Africa, in South East Asia and everywhere, and it’s a big surprise to many to hear that in Europe we don’t have access to some medicines.”

Leave a Reply